A Finance Directors lot

…it’s more about people than numbers

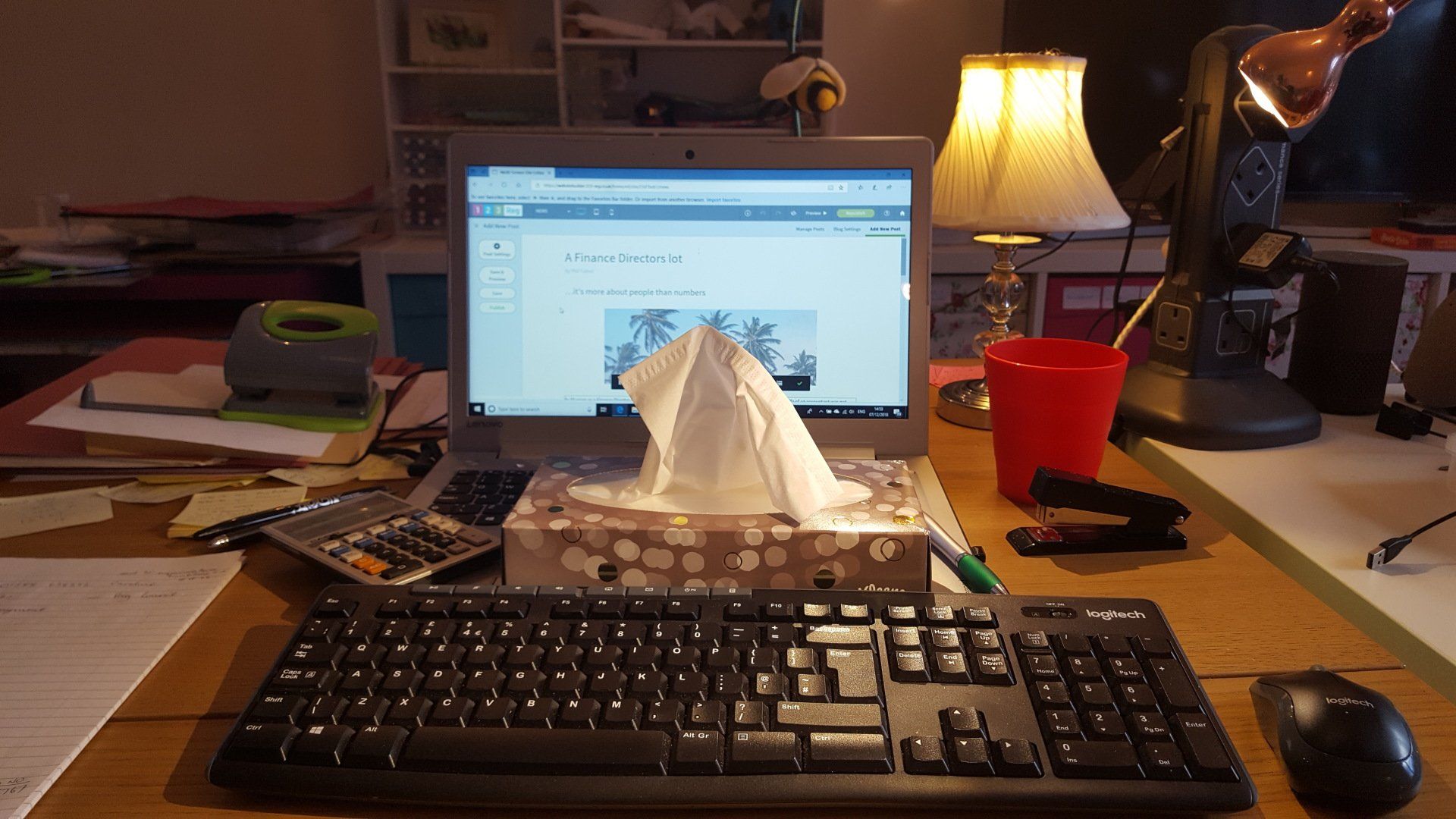

In 16 years as a Finance Director of a growing dynamic business, despite what the stereotype may suggest, the life of an accountant was not always a dull and boring one. Of course, it did have its moments, but no more than any other job and on reflection when speaking with friends in other jobs, it would at times be positively dynamic. To be successful it is more about people than numbers, you can understand numbers most of the time, but understanding and managing people is not quite so easy and yet it is so key to overall success. I firmly believe that the box of tissues stationed on the corner of my desk as a means of listening and consoling upset staff were equally as important as the loyal calculator sat next to it.

Business is ultimately simple and tends to be complicated by people, and my philosophy was always, set up processes that are simple and logical, and delegate them down the team with the appropriate level of support. The finance process I always likened to that of the old circus spinning plates scenario, as soon as you addressed one problem area, something different would pop up elsewhere. That in my view was not necessarily a weak system, it simply was just what happens. The business world is a dynamic process and therefore the challenges will change on a daily basis, but the challenge of managing staff will always be there.

There are several key features which in my view underpin this

· Understanding the basics of a business should never be lost , it gives a good understanding of the business dynamics but also an appreciation of the day to day issues faced by members of your team. If the processes are robust and the team is good, the levels of risk are low and ultimately the financial integrity of the business is maintained. Even when working at a senior level never lose sight of the basics and do not take them for granted.

·Such an understanding builds credibility and respect with the team and spending time with young and new members of staff should not be underestimated. Treat your staff as you would like to be treated, look after good, hardworking loyal staff and address those that don’t fit in to the team as early as possible not to upset the balance. This not only helps the FD, but builds respect amongst the team, and respect should not just be a given as it must be earned.

So, bearing this in mind what does the FD of a SME need to concentrate on in order to be successful, and what is success?

1.Don’t forget the basics and know where the dangers lie.

My old boss used to say to me on a regular basis “Do not underestimate the power of analytical review young Philip”. He was right, in fact he was nearly always right, he understood the numbers and he understood the risks. As a result of this his experience homed in to the key areas and he always had the ability to ask the right challenging questions at the right time. This was not luck, as I used to suggest, it was experience born out of a good understanding of the business.

2.An FD needs to be able to do the basics, such as accurate cashflows & management accounts and understand what is in the company balance sheet. They always need a good appreciation of the working capital requirements of the business, businesses do not fail due to a short-term fall in profitability, but they do fail if there is a shortfall in cash. An FD does not need to be a tax or a legal expert but should know enough so that they realise when additional knowledge is required, whether that is from their network, research or tax expert.

3.An MD/CEO always requires an impartial sounding board to discuss various matters, such as staffing and strategy/tactics as well as someone who they trust to have the business’s best interests at heart. The person who should have the best oversight of the company is the FD, who not only knows the numbers and the business inside out, but also has an appreciation of the wider business community and the environment in which the company operates.

4.With reference to a wider appreciation of the business the FD needs to be a Jack of all trades, but a master of none (other than the company finances of course). The FD needs to be able to take an objective and common-sense view of the strategy that the company is employing to achieve its goals, and in order to do this has to have a proper understanding of the challenges faced by Sales, Operations, Recruitment, IT and any other of the significant departments from within the business.

5.SMEs frequently seem to work on the basis that the MD, Sales and Operations Directors have clearly defined roles, so any tasks outside these areas fall, by default, to the FD. Having IT issues or employment tribunals is not what any business wants and having a major contract go wrong and then finding that there are holes in the terms and conditions could prove fatal, such issues tend to fall on the desk of the FD and this simply comes with the territory.

6.An FD needs to be able to communicate effectively with not only financial staff, but also non-financial staff; from directors down to junior staff. They need to be both persuasive and diplomatic. There will be times when an FD disagrees with another director or the MD and needs to be able to get their message across in such a way that it does not alienate the other individual but will result in them changing what they currently do. This may take some period of time, so patience is essential.

7.Business quite often assume that anyone over 50 is counting the days until retirement and has no drive or energy. This may be true for some people, but the majority still have a lot to offer any company and remain motivated to help businesses grow. Of course, on the plus side, older FDs bring experience. An FD who has worked in business for 25+ years has probably seen many of the issues that SMEs encounter and knows what does and does not work and bring a measured approach to the problem. They will have worked with many other directors and picked their brains for what works, and what does not work in their own areas of expertise.

The FD is not just a number cruncher. An experienced FD is someone who has an all-round approach to the business and so should be involved in the commercial and strategic areas, using their knowledge of the financials and their experiences within other businesses to shape their views all with the aim to improve the business performance.

Success is ultimately keeping everybody happy and that can be difficult. There are shareholders, customers, suppliers, banks, employees and other authorities. In some ways the skill is to convince each and every one of them when you deal with them, that they are the most important.

That is fine but just don’t encourage them all to be in the same room at the same time!

Phil Talbot a Chartered Accountant and Business Consultant. He specialises in the provision of business and accounting advice for small business offering part-time FD services. With over 25 years in Senior Finance and Director roles he also has specialist knowledge and experience of the Health and Social Care Sector. Any businesses interested please contact phil.talbot@pjtconsultancy.co.uk